Owning a home is more than just having a place to live—it is also a way to build financial security. Over time, as you pay down your mortgage and your property value increases, you create something called home equity. Many homeowners do not realize that this equity can be turned into cash through a financial tool called a home equity loan.

This guide explains everything you need to know about home equity loans in clear, simple terms. You will learn what they are, how they work, the benefits and risks, and whether this option is right for you.

What is a Home Equity Loan?

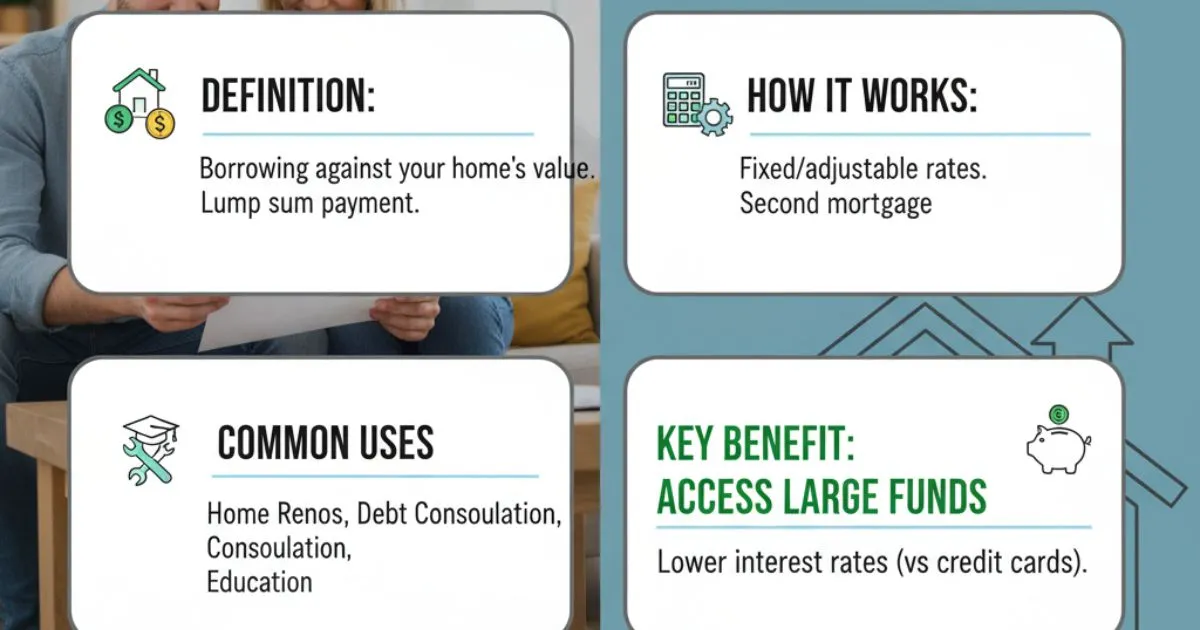

A home equity loan is a type of loan that lets you borrow money against the equity in your house.

Understanding Equity

Equity is the difference between what your home is worth and what you still owe on your mortgage. For example:

- If your home is valued at $300,000,

- And your mortgage balance is $200,000,

- Then your equity is $100,000.

A lender allows you to borrow a portion of that equity, usually between 75% and 85% of the home’s value (minus what you owe).

Simple Definition

Think of a home equity loan as a “second mortgage.” The bank gives you a lump sum of money, and you pay it back in fixed monthly installments with interest over a set number of years.

How Does a Home Equity Loan Work?

A home equity loan is straightforward once you understand the process.

- Lump Sum Payment – The lender gives you the approved loan amount in one payment.

- Fixed Terms – You agree to a fixed interest rate and repayment period, often 5–30 years.

- Monthly Payments – You pay the same amount each month, which includes principal and interest.

- Collateral – Your home secures the loan. If you stop paying, the lender can foreclose and take the property.

Example

Suppose you borrow $50,000 with a 10-year term at a 6% fixed interest rate. You will make equal monthly payments until the balance is paid off. Unlike credit cards or personal loans, the interest rate is lower because the loan is backed by your home.

Home Equity Loan vs. HELOC (Home Equity Line of Credit)

Many people confuse a home equity loan with a HELOC. While both use your home’s equity, they are not the same.

| Feature | Home Equity Loan | HELOC (Home Equity Line of Credit) |

|---|---|---|

| Payment | One lump sum | Borrow as needed, like a credit card |

| Interest Rate | Fixed | Variable (changes over time) |

| Repayment | Fixed monthly payments | Payments depend on how much you borrow |

| Best For | Large, planned expenses | Ongoing or flexible spending |

Quick Tip:

- Choose a home equity loan if you know the exact amount you need (like a $40,000 renovation).

- Choose a HELOC if you want flexibility (like paying tuition over several years).

Advantages of a Home Equity Loan

Many homeowners prefer home equity loans because of their clear benefits:

- Lower Interest Rates – Rates are usually lower than credit cards or personal loans.

- Fixed Monthly Payments – Predictable payments make budgeting easier.

- Tax Benefits – In some cases, interest may be tax-deductible (check current tax laws).

- Access to Large Sums – You can fund major expenses that would be difficult with other loan types.

- Long Repayment Terms – Terms can stretch up to 30 years, lowering your monthly cost.

Disadvantages & Risks

Before applying, consider the risks of a home equity loan:

- Risk of Foreclosure – Since your home is collateral, missing payments could cause you to lose it.

- Closing Costs – Lenders may charge fees (appraisals, origination, legal fees).

- Less Flexibility – Once you receive the lump sum, you cannot borrow more without applying for a new loan.

- Debt Increase – Adding another loan increases your overall debt load.

- Impact on Credit Score – Late payments or default harm your credit.

Common Uses of a Home Equity Loan

People use home equity loans for big, one-time expenses. Popular uses include:

- Home Renovations: Remodel a kitchen, finish a basement, or build an addition.

- Debt Consolidation: Pay off high-interest credit cards and replace them with one lower-interest loan.

- Medical Expenses: Cover large bills or long-term care costs.

- Education Costs: Fund college tuition or vocational training.

- Major Purchases: Buy a second property, start a business, or cover wedding expenses.

How to Qualify for a Home Equity Loan

Not everyone qualifies for a home equity loan. Lenders usually look at:

- Credit Score – Most lenders require at least 620, but higher scores get better rates.

- Debt-to-Income Ratio (DTI) – Your monthly debt should be less than 43–50% of your income.

- Sufficient Equity – You need at least 15–20% equity in your home to qualify.

- Income Verification – Pay stubs, W-2s, or tax returns may be required.

- Property Value – An appraisal confirms your home’s current worth.

Tips Before Applying

If you decide a home equity loan fits your needs, take these steps first:

- Compare Lenders: Shop around for the best interest rates and terms.

- Understand All Costs: Look beyond the interest rate—check closing costs, fees, and APR.

- Borrow Responsibly: Only take what you need, not the maximum amount offered.

- Consider Alternatives: Explore refinancing, HELOCs, or personal loans.

- Check Your Finances: Make sure you can handle the extra monthly payment.

Frequently Asked Questions (FAQs)

1. Is interest on a home equity loan tax-deductible?

Yes, but only if the money is used to buy, build, or improve your home. Always check current IRS rules.

2. How much can I borrow with a home equity loan?

Typically, up to 75–85% of your home’s value minus your mortgage balance.

3. Can I use a home equity loan to buy another house?

Yes, some homeowners use the funds for investment properties, but it carries higher risk.

4. How long does approval take?

The process may take 2–6 weeks depending on the lender and required documents.

5. Is a home equity loan the same as refinancing?

No. Refinancing replaces your current mortgage with a new one, while a home equity loan adds a second loan on top of your existing mortgage.

Conclusion

A home equity loan can be a smart financial tool if used carefully. It lets you tap into the value of your home to fund major expenses, consolidate debt, or invest in your property. The fixed interest rates and predictable payments make it easier to manage than some other forms of credit.

However, remember that your home is on the line. Borrow only what you need, understand all the costs, and have a solid repayment plan. For many homeowners, a home equity loan provides the funds they need while keeping payments manageable—but only when used responsibly.